Sign up for the Points Party newsletter

Your friendly guide to the complicated world of credit card and travel points. Sign up now to get Dan Frommer’s latest tips and favorite travel experiences.

My big-picture points strategy — and, really, my big-picture life strategy! — is to figure out what I like and what I want and then do more of it. My interest in points has always been to turn my everyday spending into amazing “free” travel experiences.

Around the beginning of each year, I reflect on my travel priorities and points strategies for the year ahead.

I then take those big ideas and decide which cards and loyalty programs to use, keep, cancel, or add, as benefits often reset around the beginning of the year.

As you start to plan out your travel goals for the year, think about what might help get you there: What airlines fly most conveniently to your destinations? Are there specific hotels you’re interested in checking out? What rewards programs or credit cards can help with those? It’s going to be different for everyone, but that’s how to keep your points strategy working for you.

For 2020, I’m mostly going to keep things the same as last year.

For credit card spending, I’ll continue to focus on mostly earning Chase Ultimate Rewards points — which are valuable and versatile — plus some American Express points.

I’ll continue to mostly spend those Chase points for airfare on American Airlines, hotel bookings through its travel portal, and by transferring them to other loyalty programs, such as British Airways and Hyatt, to book award flights and rooms.

I’ve had a tougher time getting good value from Amex points, but I’ve found a few sweet spots lately — mostly by transferring them to other programs — and will do a full issue about that soon.

Specific-card-wise:

For travel loyalty, I’ll continue to focus mostly on American Airlines and the Oneworld alliance.

While many people just fly what’s cheapest, I’ve found that the benefits of accumulating points on a single airline is worth it, even if it costs a bit more. And if you fly enough, earning elite status, which has perks including free access to extra-legroom seats, international lounge access, and occasional business-class upgrades — plus generally better service from the airline.

I flew less in 2019 than in 2018, thanks to my new business and time overseas, and I’m not sure how much flying I’ll do for work in 2020. That means the end of American’s Executive Platinum status for me, for now. But from my home base in New York, American still makes the most sense for the places I fly the most: Los Angeles, London, Paris, San Francisco, Chicago, and Tokyo.

For many New Yorkers, Delta is a better option. If you’re based in San Francisco, it’s probably United or Alaska.

American, like most big airlines, has done a bunch to make its points less valuable over the years, such as increasing the number of miles you need to book award tickets. But its points are still useful for free flights and upgrading coach tickets to business class. For our upcoming flight to Paris, we’re already confirmed in business class via cash-and-miles upgrades.

Last, I’m not going to be loyal to any hotel chain this year.

When I was traveling every few weeks for work, I focused on Hyatt to consolidate points earnings and perhaps receive some perks. But even with the second-highest Hyatt status the past couple of years, I haven’t found it worth it, beyond occasional later check-out and earning some bonus points. I keep a Chase World of Hyatt card (refer-a-friend link) active — you get a free night every year, which more than pays for itself — but I didn’t use it otherwise this year.

Mostly, I just have no interest in big, boring chain hotels, unless it’s something special.

Instead, I’m going to keep trying interesting boutique hotels and chainlets, like The Line, Palihotel, Tokyo’s Trunk, The Proper, Ace Hotel, etc., booking either with Chase points or through a third-party booking site with its own loyalty program, such as Hotels.com or Hotel Tonight. And for anything more than a few nights, you’ll probably find me in an Airbnb.

Photo: Courtesy Hyatt

Since Hyatt opened its luxurious Andaz Tokyo in 2014, it’s been one of my all-time favorite points redemptions for a couple of nights every year. The rooms are big, the pool is nice, and it’s in a great location for running.

But for my most recent trip this past November, I revisited Hyatt’s more famous hotel across town, the Park Hyatt. Wrapping up a solo business trip, I was looking for a bit more energy. While the Andaz is calm and understated, the Park Hyatt still has an iconic buzz about it 25 years in.

Photo: Courtesy Hyatt

The room itself didn’t feel as special as it did on my first visit six years ago — a refresh is overdue. (The hotel also did a weird thing, seemingly as some sort of upgrade, where it smooshed two king beds together into a giant mass.) And its location, deep in the corporate-office-tower neighborhood of Shinjuku, is still a challenge if you aren’t being chauffeured around town.

But there’s still nothing like stepping out of the elevator into its tall, glass lobby high above Tokyo, washed in sunlight or glowing night sky, with piano keys tinkling and echoes of multi-lingual chitchat. The rooftop pool remains a delight. And the New York Bar, while a bit cheesy, played perfect companion over a Suntory Hakushu on the rocks.

Standard rooms cost 30,000 Hyatt points per night, which you can accumulate with the Chase World of Hyatt card (refer-a-friend link) or also transfer 1-to-1 from the Chase Sapphire. That’s a lot. But with cash rates often more than $600 per night, it can be a good deal, representing more than 2 cents per point in value.

Photo: Courtesy Square

Most of my points strategy focuses on amazing free travel. That’s where the experience feels most worth the effort, and where I get the most value. But sometimes — rarely! — a card comes along where the cash-back deal is good enough that it can’t be ignored.

That’s why the Cash Card from Square is one of the few cards I added to my wallet this year. It’s part of the Cash App, and if you sign up for free here and send someone $5, we’ll both get $5.

The Cash App is sort of like Venmo. It’s a digital wallet that lets you send money to friends and businesses using their phone number, email, “cashtag,” etc. You can add money to your Cash App balance using your bank account, as you’d expect. It’s simple and elegant, and is turning into a big hit for Square.

Last year, Square launched the Cash Card, a Visa debit card that lets you pay for things in stores and online with your Cash App balance. It’s all prepaid, so there’s no credit or credit check involved.

Cash Card purchases don’t earn points, but there’s a clever feature called “Boosts” that gets you an instant rebate. For example, at coffee shops, you can get $1 back on any purchase that’s more than $1.50. Or you can get 10% back — up to $7.50 — on purchases at Chipotle, Taco Bell, Domino’s Pizza, Chick-fil-A, or Whole Foods.

The coffee Boost is pretty great. So far, I’ve used it 67 times to earn $67. It usually covers my dollar tip on an iced cortado; for cheaper orders like an espresso or drip coffee, it can cover much of the cost of the drink.

Why use the Cash Card at coffee shops instead of a card that earns points? Simply, because it’s a much better deal.

It’s worth the caveat that the majority of my coffee spending is at fancy indie coffee shops or smaller chain-ish places like Stumptown, where the loyalty system is still a punch card.

What if you’re a Starbucks regular? If so, you’re probably already heavily invested in the Starbucks card, including mobile payments, pre-ordering in the app, earning “stars,” and auto-reloads. It’s possible to double-dip here if you want: I just used the Starbucks iPhone app to load $10 onto my Starbucks card using the Cash Card, and got $1 back.

As I mentioned earlier, the Cash Card also has Boosts available at a few restaurants and at Whole Foods, where you can earn 10% back, up to $7.50. If you shop there regularly or visit the salad bar for lunch, that can be a great deal. For bigger grocery purchases, you might be better off paying with a points card, such as the Amex Gold Card — but that’s another article.

One more note: You can only have one Boost selected at a time, and you can only use a Boost every 30 minutes. So you have to remember to go into the Cash App and toggle back and forth between the Whole Foods and coffee Boosts before you pay.

It’s easy to see how the Cash Card could end up saving you a few hundred dollars a year with these Boosts. The point, of course, is to get you in the habit of paying for all sorts of things with the Cash Card, and to use the Cash App as your primary payments tool.

But for now, I think of it as my caffeine equivalent of a gas card, mostly used via Apple Pay. If you’re interested in trying the Cash Card and Cash App, here’s my refer-a-friend link to get started.

Photo: Courtesy Hyatt

The Hyatt Regency Kyoto was a quiet and comfortable home for two nights on my Japan trip a few weeks ago, and I got a good deal using Hyatt points.

While the Hyatt Regency name may conjure ideas of a frenetic hotel for business travelers, Kyoto’s is nestled in greenery, across the river from downtown Kyoto in the Higashiyama ward, and has a classier feel. See if you can get a room with a view of the garden.

Photo: Courtesy Hyatt

It’s a quick metro ride to the Fushimi Inari-taisha shrine, which helped me get there early enough for a morning hike before the tour-bus crowds showed up. And if you’re looking for good (if highly Instagrammable) coffee, there’s an %Arabica outpost a short walk away in Higashiyama. I also daytripped to Osaka on the metro, finally visiting the amazing Truck Furniture showroom.

I paid for my stay using Hyatt’s Points + Cash rate, which got me a good deal:

And as a nice bonus, I had an offer on my World of Hyatt card (refer-a-friend link) for a 20% rebate on the cash portion of my stay, up to $51, which I maxed out. So, all in, I paid 20,000 points and about $245 for two nights, and earned 2,600 points toward another Hyatt stay. I’m happy with that.

Unfortunately, you can’t get that deal anymore: Hyatt recently changed how it prices Points + Cash stays. Instead of a fixed nightly rate for the cash portion — ¥13,500 in my case — it now charges half the going cash rate for standard rooms. At nicer hotels with higher prices, such as the Hyatt in Kyoto, that’s going to be much more expensive, to the point where it’s often not worth it. (Normal points stays, which are 20,000 points per night here — and no taxes — can still be a good deal, especially when rooms are $400 or more per night.)

Anyway, next time, I plan to check out the Ace Hotel Kyoto that’s currently under construction, scheduled to open in 2019.

Chase is offering an extra point per dollar when you pay with Apple Pay or Google Pay through the end of the year using a Sapphire Reserve, Sapphire Preferred, or Freedom Unlimited card. That means dining and travel purchases earn 4 points per dollar on a Sapphire Reserve, and everything earns 2.5 points per dollar on a Freedom Unlimited, if you pay with Apple or Google Pay. This includes in-app Apple Pay transactions, including things like Lyft and Uber rides.

Speaking of Lyft… Through Christmas Day, you can earn 10 Delta SkyMiles per dollar on Lyft rides to or from a US airport, and 3 miles per dollar on other US Lyft rides, if you sync your Delta and Lyft accounts here and enter the promo code SKYMILES10X in your Lyft app. This is in addition to any points you’d earn from your credit card. After the promotion ends, you’ll earn 1 Delta mile per dollar on US Lyft rides and 2 miles per dollar on airport rides. Not a bad bonus.

The holiday shopping and travel season is about to get intense. It’s a great opportunity to earn extra points for your spending — and to use points to save even more cash than usual.

I like to start by thinking about what my points goals and travel needs are for the rest of the year:

“Shopping” is a very broad category, and for most cards and merchants, offline and online, you’re going to earn the lowest, standard amount of points — usually 1 point per dollar, or whatever your card gets.

But there are some lucrative exceptions if you’re willing to do a little work.

This quarter, for example, the Chase Freedom bonus category includes shopping at department stores and warehouse clubs, plus transactions made with Chase Pay.

I’ve written about shopping portals before, but now’s a good time to pay extra attention and make sure to remember to start your e-commerce shopping excursions at your favorite points portal for holiday specials. It’s a hassle to remember, but I’m always surprised at the breadth of sites that participate, such as Apple (currently 2 points per dollar), Uniqlo (4 points per dollar), Walgreens (4 points per dollar), and Walmart’s Jet (2 points per dollar).

For shopping at Amazon, the best bet right now seems to be the Amazon Prime Rewards card, which earns 5% back on Amazon (and Whole Foods) purchases year-round, good toward future Amazon purchases. Amazon is also a 5%-back bonus category for the Discover It Cash Back card this quarter, and if it’s your first year as a cardmember, they’ll double your cash back at the end of 12 months.

And if you’re an Amex person, the newish Amex Gold card offers 4 points per dollar on up to $25,000 of U.S. supermarket purchases. That’s helpful when you’re buying groceries for a holiday dinner, but it could also be lucrative for other purchases: Remember that Whole Foods and most other big grocery stores sell Amazon (and plenty of other) gift cards that you can buy at the higher-earning rate — because you’re buying them from a grocery store — and use elsewhere. (Another Amex, the Blue Cash Preferred card, offers 3% back at select U.S. department stores, and 6% back on your first $6,000 on annual supermarket purchases.)

Some credit card perks are doled out by your “anniversary” date — the actual day when you first became a cardholder. But others are based on the calendar year. And with the calendar year coming to a close, now’s a good time to make sure you’re getting all the free or discounted stuff you’re allotted for the year.

For example, both the American Express Platinum and the Amex Gold card have an “airline benefit,” where you get to pick one airline and have $200 worth of expenses reimbursed on the Platinum card and $100 reimbursed on the Gold card. This benefit resets at the end of the calendar year, so you can use it in December and then again in January. If you haven’t used up your full allotment for the year, see if it makes sense to make a reimbursable purchase by the end of December. These include things like baggage fees, pet fees, seat assignment fees, in-flight food/beverage/entertainment purchases, and lounge passes. (Gift certificates aren’t supposed to work, but sometimes they do.)

The Amex Platinum also offers a monthly reimbursement on $15 worth of Uber rides. But in December, it reimburses up to $20 worth of Uber rides. Get that trip in!

And Amex, Chase, and other card programs have “Deals” or “Offers” that offer a discount or certain number of dollars worth of reimbursement for purchases at participating merchants, once you’ve activated the offer. These are usually personalized, but for example, right now I can get $15 off $75 at J.Crew if I make the purchase on my Starwood Amex, or 20% off a Hyatt bill (if I spend $100) on my Hyatt/Chase Visa. If you’re going to be shopping anyway, it’s worth a few minutes to see if there are any discounts you can secure.

With the holidays fast approaching, it’s not realistic to book a family trip for four using your points — you’re better off doing that months in advance.

But for last-minute or one-off flights, or trips where you have some flexibility in timing, booking with points can save a bunch of cash. Especially in business or first class. And with all the stress of the season, when’s a better time to treat yourself than now?

For my Christmas flight to Los Angeles, I’ve so far opted to spend 30,000 American Airlines miles for an “anytime” one-way coach award ticket instead of spending $300+ cash.

That isn’t the best redemption rate — barely more than 1 cent per dollar — but I have a surplus of miles, and won’t need to earn any more elite-qualifying miles by then to reach Executive Platinum status for next year. (I will in January, when the counter resets for the following year, so I’ve booked my return flight as a normal, cash ticket.)

Plus, because it’s an “anytime” award, I can cancel and rebook if a business-class “saver” seat opens, or if the cash price drops profoundly for some reason. And I’ll get to use my Amex $100 airline credit to pay for most of my dog’s pet fee both ways.

Uber is launching a loyalty program, Uber Rewards, which earns 1 point per dollar spent on UberPool rides and Uber Eats orders, 2 points per dollar spent on UberX and UberXL rides, and 3 points per dollar for UberBlack.

If you reach 500 points in a 6-month period, you’ll get Gold status, which includes “flexible cancellations” — a refund on your cancellation fee if you rebook within 15 minutes. At 2,500 points, you’ll get Platinum status, including price protection on a specific route, “letting you lock in lower prices between your two favorite places on UberX, even during traffic or busy times of day.” Diamond status at 7,500 points includes phone support, the ability to request only highly-rated drivers, and “complimentary surprise upgrades.”

Uber will also give you a $5 credit for every 500 points earned — 2% back on your UberX spending.

The benefits sound fine, but nothing special. I’ll probably continue choosing rides on a one-off basis — between Uber, Lyft, taxis, and Juno in New York — depending on price and availability.

American Airlines is making it harder to reach its highest status level, Executive Platinum, which comes with four worldwide upgrades and a bunch of other benefits. Starting next year, flyers will need to earn $15,000 elite-qualifying dollars, or EQDs, up from $12,000 this year. This effectively means spending $15,000 on flights over the course of the year, though there are other ways to earn EQDs.

But one of those techniques is also getting gutted next year: Barclays has slashed the ability to earn EQDs via its American Airlines “Aviator” credit cards. Through this year, you’ve been able to earn $3,000 EQDs by spending $25,000 on the Aviator Red card. Those with the higher-fee Aviator Silver card could earn another $3,000 EQDs for spending another $25,000, meaning $6,000 total EQDs.

That makes a major difference in reaching the next status level, especially for those who fly a lot of long, cheap flights. But next year, Aviator Red cardholders won’t be able to earn EQDs at all, and Aviator Silver users will have to spend $50,000 on their cards just to earn $3,000 EQDs. That’s a major change. (Though still better than Delta, where you have to spend $250,000 on a credit card to waive its Medallion Qualifying Dollar requirement for Diamond status!)

The big picture: American (and most airlines) are increasingly reserving their best service and benefits for the customers who spend the most money, not just those who fly the most (or are the most “loyal”). That makes business sense. But in my case — and I still need to do the math, which I’ll happily share with you! — it will probably mean ditching the Aviator Silver altogether next year. And probably settling for lower status starting in 2020.

Photo: Courtesy Fairmont

When is using your credit card points, airline miles, or free hotel nights actually a good idea? There are two ways to measure this.

One is by trying to make sure you’re always getting a “profitable” redemption.

Sites like The Points Guy maintain regularly updated points “valuation” listings — to a rather amusing level of precision. Some of these calculations seem more like art than science, but for example, at the time of writing, they say Chase points are worth 2.2 cents each, Delta miles 1.2 cents each, and Marriott points 0.9 cents each.

If you believe that, with a little math, this will give you a remote idea of whether your redemption is a good deal or a bad deal.

Using Chase points as an example, if you redeem 100,000 points, they should get you “value” near $2,200. So if you find yourself transferring those 100,000 Chase points to United to redeem for a roundtrip coach flight worth $800, at 0.8 cents per point, that’s not a good deal.

But if those 100,000 points get you a roundtrip business-class flight worth $10,000, on paper, you’ve just gotten 10 cents per point worth of travel — a great deal! And surely a nice travel experience.

But a better way to measure the value of a points redemption is to consider the big picture: Are you getting what you want or need out of this? Because that’s ultimately what matters the most — and really the whole point of putting time and energy into this in the first place.

Is your goal to fly as cheaply as possible to as many places as you can visit? Or to fly in a first-class suite that comes with champagne and pajamas once in a while?

To stay in a modest hotel that you’ll only sleep and shower in? Or a sleek luxury hotel with a nice swimming pool?

Or maybe you just need to get there — maybe on short notice — and don’t want to — or can’t afford to — spend cash.

When I redeem points, rather than focus just on their theoretical dollar value, I think about a few things:

These questions will lead to far more subjective answers than the simple dollar equation I started with. But they’re the real questions to ask yourself. And the answers will probably change over time.

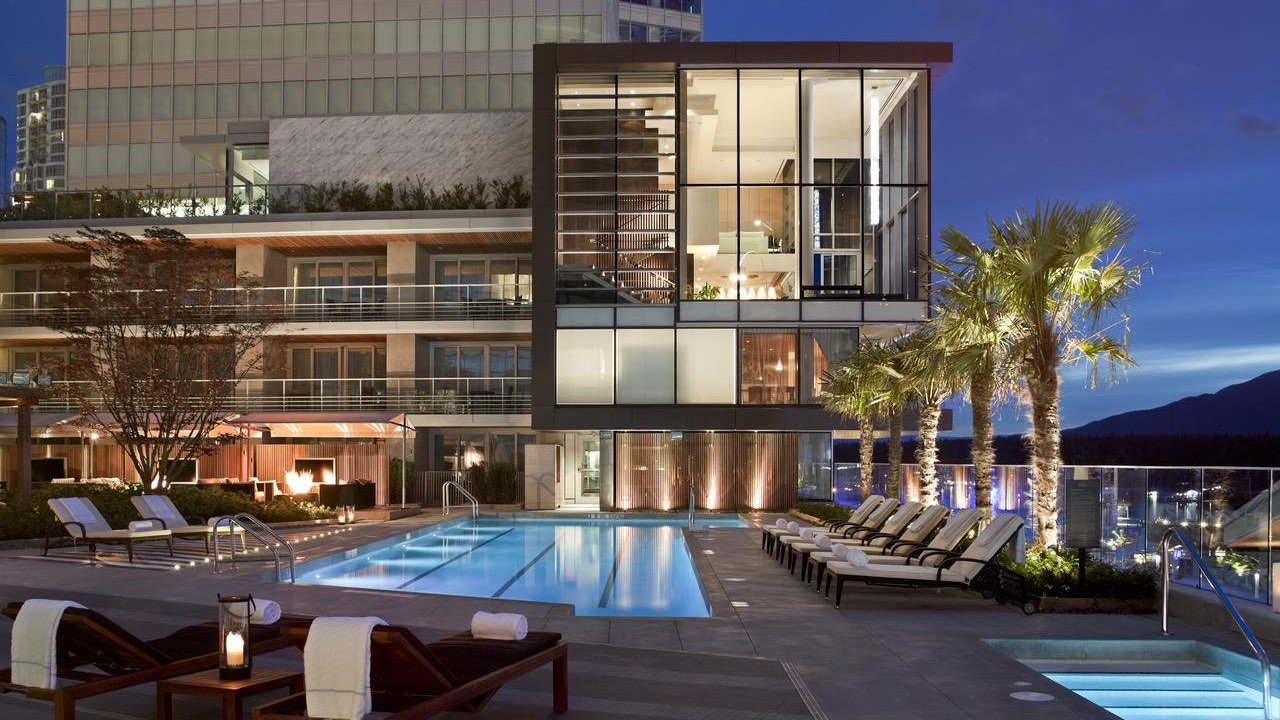

On a couple of occasions, I’ve been happy to redeem a bunch of American Airlines miles way below their theoretical value just to spend a “free” night in a nice room at the Fairmont Pacific Rim in Vancouver (photo above). You’ll have your own tradeoffs to consider.

And this goes beyond travel, too. Maybe you’re more interested in getting free paper towels from Amazon than plane tickets right now. That is fine! Focus on that.

As I wrote when I launched Points Party, points are a valuable currency — and they’re fun! It’s smart to maximize the value you’re getting, but if the process and rewards aren’t enjoyable, then it’s not worth the effort.