Getting more from your Chase Sapphire Reserve

The Chase Sapphire Reserve is my favorite credit card for travel points. In short, that’s because it allows you to earn a lot of points quickly and redeem them at a good rate, easily making its high annual fee worth the investment.

Here are two intermediate-level strategies that will help you earn more every year — potentially tens of thousands of points, worth hundreds of dollars in free travel — with no added cost.

1. Get one or both of these other Chase credit cards from its “Freedom” line, with different points-earning possibilities

I actually only use the Sapphire Reserve for travel and dining purchases, where it earns 3 points per dollar, and foreign transactions, as it has no fee for those. For most everything else, I generally use one of Chase’s two Freedom cards.

These cards were designed for more entry-level users, and have no annual fee. But when combined with a Chase Sapphire Reserve or Preferred, they add serious points-earning potential.

- The Chase Freedom Unlimited (refer-a-friend link) earns 1.5 points per dollar on everything, regardless of category. That’s all. But that’s 50% more than the 1 point per dollar that the Sapphire Reserve earns on “everything that’s not travel and dining” spending.

- The Chase Freedom (refer-a-friend link) earns 5 points per dollar on specific bonus categories of spending that rotate quarterly. This April through June, for example, you can earn 5 points per dollar at grocery stores and when spending through PayPal or Chase Pay.

The play for both of these is that you can use Chase’s Ultimate Rewards portal to transfer the points instantly to your Sapphire, where they’re worth a lot more.

- For starters, as discussed in greater detail here, you can redeem them to book flights or hotel rooms through Chase’s portal at a rate of 1.5 cents per point.

- Or you can transfer them to 13 partner programs, including United Airlines, Hyatt, Southwest, and Air France, where they could potentially be worth much more in award redemptions.

Because of that flexibility and its potential, I generally assume Chase points are worth 2 cents per point — twice as much as many cards’ points programs, which you can often only redeem at 1 cent each.

The challenge is that you’re now one of those people who has to carry and manage multiple cards, thinking about what category your purchase will fall into and which card to use. But the benefits are obvious:

- If you were using the Sapphire Reserve for everyday, non-travel-or-dining purchases — grocery shopping, home goods, e-commerce, etc. — you’d be earning 1 point per dollar, or about 2% back.

- But if you use the Freedom Unlimited for those non-travel-or-dining purchases, you earn 1.5 points per dollar, or about 3% back. That’s a 50% bump, and we aren’t even talking bonus categories yet.

- For travel and dining purchases, continue to use the Sapphire Reserve and get 3 points per dollar, representing about 6% back in points value.

- Use the Chase Freedom only for its quarterly bonus categories; at 5 points per dollar, you’re effectively earning back 10% of your spending in points value. Boom.

There is one limit with the Freedom: You’re capped at 7,500 points per quarter from bonus categories, or an average $500 per month of spending on those categories. Still, if you can max out these categories every quarter, that’s 30,000 points over the course of a year — which translates to roughly $600 of rewards value. That’s just for remembering to use this free card in specific categories.

What if the categories don’t line up with your spending? Get creative! Example: Grocery stores — 5 points per dollar this quarter — and drugstores often sell gift cards, which you can use to buy things elsewhere.

It’s admittedly a bit of work to remember which card to use when, so this isn’t for everyone. If you insist on only carrying one card, it’s still the Sapphire Reserve. But if you can handle some complexity, it can pay off with hundreds of dollars a year worth of “bonus” rewards.

2. Shop at major e-commerce sites through Chase’s portal to earn even more points

Fair warning: This is going to require a level of habit-building that you might not have time or commitment for.

But if you can remember, it’s an otherwise easy way to earn more points for shopping you’re already doing.

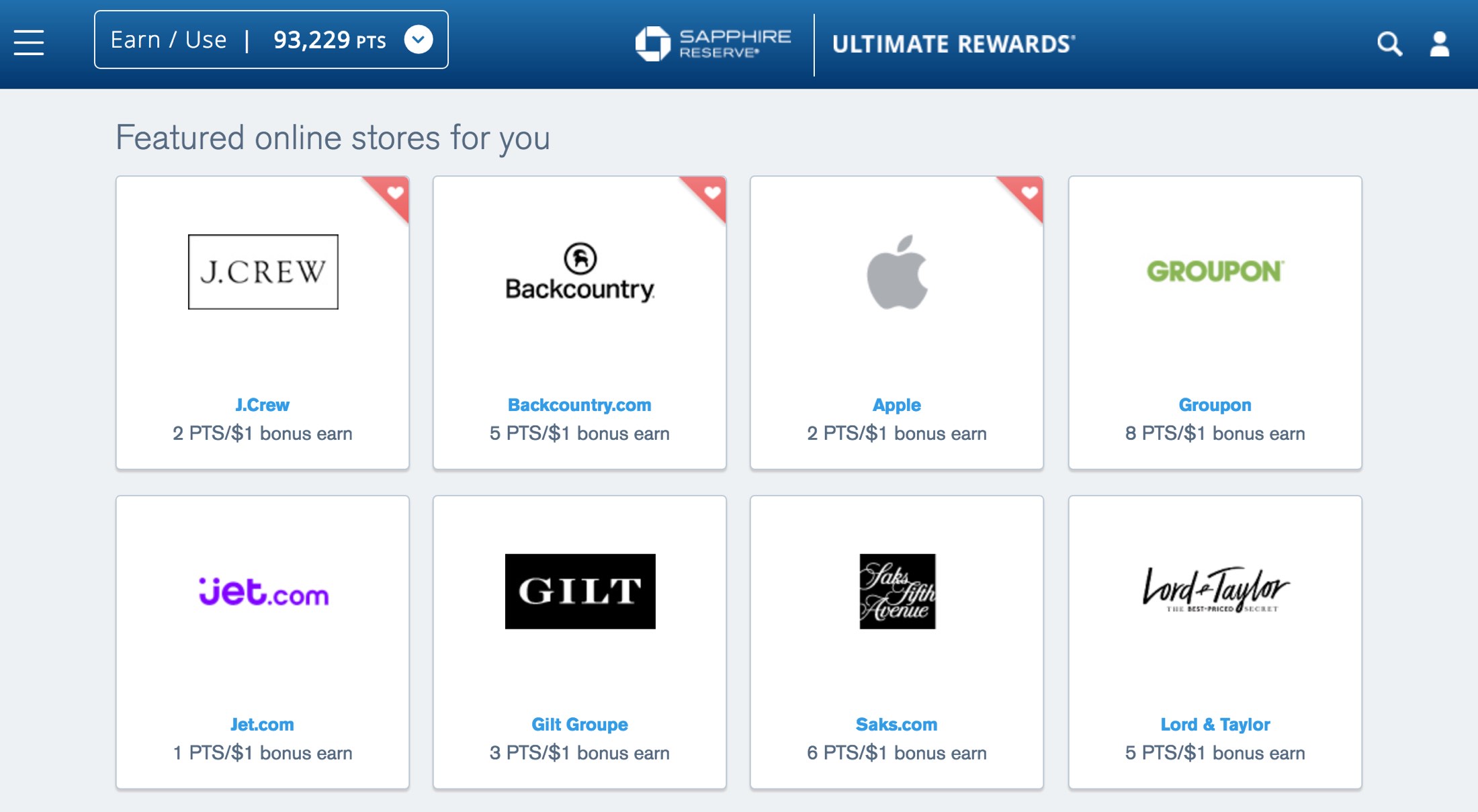

Many major e-commerce merchants offer bonus Chase points for starting your web shopping session through Chase’s referral links. If you log into Chase’s website and head over to the Ultimate Rewards section, there’s a link at the top that says “Earn Bonus Points.” This link should take you right there.

Participating online merchants include:

- Apple, J.Crew, Walgreens, Barneys New York, West Elm, Staples, and several others that currently offer 2 bonus points per $1 spent

- Nike and The North Face (4 bonus points per $1)

- Backcountry (outdoor and athletic gear; 5 bonus points per $1)

- Groupon (8 bonus points per $1)

- H&R Block (18 bonus points per $1)

- Etc.

Best of all, these bonus points are on top of any points you’d earn normally for using your credit card.

The catch: Remembering to shop through the Chase link is a semi-annoying habit you’ll need to build over time. And these partnerships don’t work in physical retail stores.

- For me, once I get far enough into shopping that I decide I’m going to buy something, I think: “Is this site big enough that it would be in the Chase portal?” And then I open a new browser tab and check.

- But I’m the kind of person who thinks obsessively about points any time money is involved. I assume you’re not, and you shouldn’t have to be. I’m testing a few tools now that promise to make this process easier, and will report back.

The value, however, is totally worth it: Assuming Chase points are worth around 2 cents each, this can earn you an extra 2% to 10% of your spending back on a lot of online shopping, just by clicking through the portal.

Btw: Chase isn’t the only company with a portal like this. American Airlines, Delta, JetBlue, United, and others have similar schemes. So if you’d rather earn points for those programs, or one of them has a fantastic special going on, by all means, use those. Websites like Cashback Monitor track and display the different number of points you can earn through each portal, but I’m pretty focused on Chase points these days.

The key here is to try to build the habit of checking for bonus opportunities before shopping — and not getting mad if you forget!